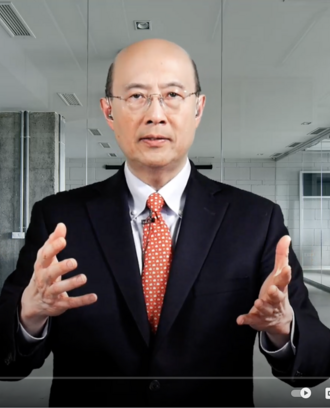

CAMBRIDGE, Mass., Aug. 2017––Financial reporting is an important mechanism to facilitate the exchange of capital between companies and investors, yet how do investors know that reports are reliable? Does regulatory oversight of auditors affect investors’ behavior? In a recent study, MIT Sloan Prof. Nemit Shroff looked at this question and found that regulatory oversight increases investor confidence in the audit process, which translates into greater access to external capital for companies. His research shows that companies issue additional capital amounting to .5% of assets and increase investment expenditures by .3% of assets as a result of additional auditor regulatory oversight.

“The challenge with financial reporting is that auditors are paid by the companies they audit, so it’s plausible that auditors allow managers excessive financial reporting discretion,” says Shroff, noting this was a critical issue in the Enron scandal of 2001. After the Sarbanes-Oxley Act was passed in 2002, the Public Company Accounting Oversight Board (PCAOB) was introduced to oversee the work of auditors. “Since then, there has been debate about the incentives and qualifications of regulators and the overall value of the PCAOB.”

In his study, Shroff uses the PCAOB international inspection program to test whether auditor regulatory oversight affects companies’ financing and investing behavior. Pursuant to Sarbanes-Oxley, the PCAOB is required to inspect the auditing procedures of all auditors that participate in the audit of companies registered with the U.S. Securities and Exchange Commission (SEC). Thus, a company outside of the U.S. with no direct exposure to SEC rules could be indirectly affected by PCAOB oversight if its auditor has even one other client registered with the SEC.

To empirically test whether auditor oversight affects company behavior, Shroff constructed a sample of these non-U.S. companies that were audited by a PCAOB-inspected auditor. Using data from 35 countries from 2002-2014, he finds that companies whose auditors are inspected by the PCAOB raise significantly more debt and equity capital following the disclosure of their auditors’ PCAOB inspection report.

Shroff explains, “Once a company’s auditor is inspected by the PCAOB and receives a clean report, the company is able to raise additional capital equal to .5% of its assets. This .5% is equal to approximately 10% of the average amount of external capital raised, which is extremely significant. While not all firms raise capital, when they do engage in this behavior, they raise 10% more if their auditor is PCAOB-inspected.”

For capital expenditures, he notes those are increased by .3% of assets after a PCAOB inspection of the company’s auditor, which is equal to about 6% of average annual capital expenditures.

This is the first paper to show that PCAOB oversight has real effects and to document the economic magnitude of those effects, notes Shroff. It also is unique in that it examines the spillover effects of SEC regulation on non-U.S. companies.

“The implication of this study is that PCAOB inspection and the content of the inspection report matter a lot. If the regulator doesn’t think the independent auditor performed a thorough audit of a company’s financial statements and reporting practices, then it affects the company’s ability to issue additional capital and invest,” says Shroff.

He adds, “This study shows that the PCAOB adds significant value to the financial reporting process. It opens up the black box of auditing, which benefits both investors and companies.”

Shroff is the author of “Does auditor regulatory oversight affect corporate financing and investment decisions?”

About the MIT Sloan School of Management

The MIT Sloan School of Management is where smart, independent leaders come together to solve problems, create new organizations, and improve the world. Learn more at mitsloan.mit.edu.