While the impact of the coronavirus has already roiled the financial markets, the worst is still yet to come, according to Andrew Lo, professor of finance at MIT’s Sloan School of Management.

“Things will probably get worse before they get better, both from the perspective of this particular outbreak but also financially,” Lo said in a recent MIT webinar that unpacked the impact of COVID-19 on financial markets.

“Part of the reason that markets are reacting the way they are is because the [government] response so far has not provided a credible set of measures that will deal with this crisis in a way that will deal with it once and for all.”

Lo acknowledged that the next few months will present a challenging set of market conditions for investors to navigate but said that looking to past scenarios — while not perfect — can provide valuable insights. “It’s been said that history doesn’t repeat itself, but it often rhymes,” Lo said. “Thinking about the past doesn’t always tell us exactly what’s going to happen, but it can give us ways of at least providing guidance in how we react.”

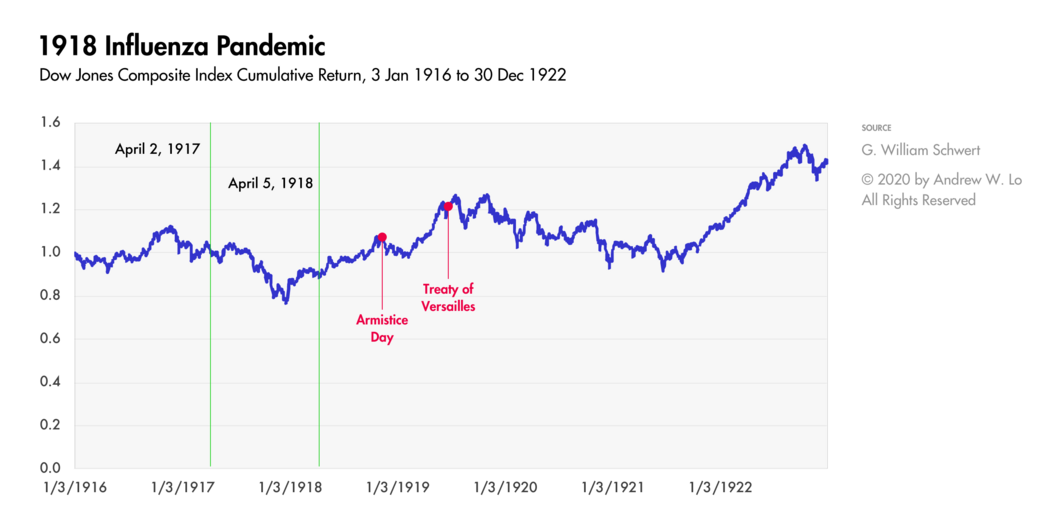

Allied troops celebrating Armistice Day around the world did not realize they were spreading the influenza virus, which was still raging in Paris on the day the Treaty of Versailles was signed, ending World War I.

The market returned after the 1918 flu pandemic

Many have compared the current coronavirus to the so-called Spanish flu, in which millions of people died. Lo noted, however, that the economic effects of the 1918 influenza pandemic were relatively short term, with industries reporting mixed results. For example, health care businesses fared better than those in services and entertainment.

“As long as you were well-diversified over that period of time, even though there were short-term losses, eventually [the market] recovered,” Lo said. “As close as we can tell, it is clear that even in something as devastating as the 1918 influenza pandemic, the economy recovered and went on to do really well after that.”

Effective intervention in the 2008 financial crisis

During the 2008 financial crisis, the government was able to restore order in the financial markets with a $700 billion Treasury fund that was used to purchased failing bank assets. This was an “unprecedented” amount of intervention, Lo said, one that helped avoid the same kind of depression seen after the 1929 stock market crash.

In contrast, a recent $8.3 billion coronavirus spending bill isn’t enough to assuage investors’ fears, Lo said, especially combined with the fact that dealing with a public health crisis isn’t like a financial crisis. The former requires scientific and medical expertise, plus sustained resources to prepare for outbreaks.

“While the $8.3 billion is a good start, we need many more billions of dollars,” Lo said, speaking two days before U.S. Treasury Secretary Steven Mnuchin proposed a $1.3 trillion stimulus package. “As we’ve seen from the financial crisis, once you start dealing with a situation in a way that gives investors confidence, once you are able to restore trust and confidence, at that point you can start turning things around.”

So, what to do? Diversify, and don’t panic

Lo said that there are “tremendous” opportunities available right now for active managers who can spot winners and losers. Diversification can also help spread bets across different assets.

“In the short run, if you need cash, and you need to be able to put money to work, you will need to preserve your capital,” Lo said. “But in the medium and longer run, there is going to be a recovery, so you need to examine your goals, your particular constraints and resources, and do not panic.”

Further reading: Here's how much the 2008 bailouts really cost