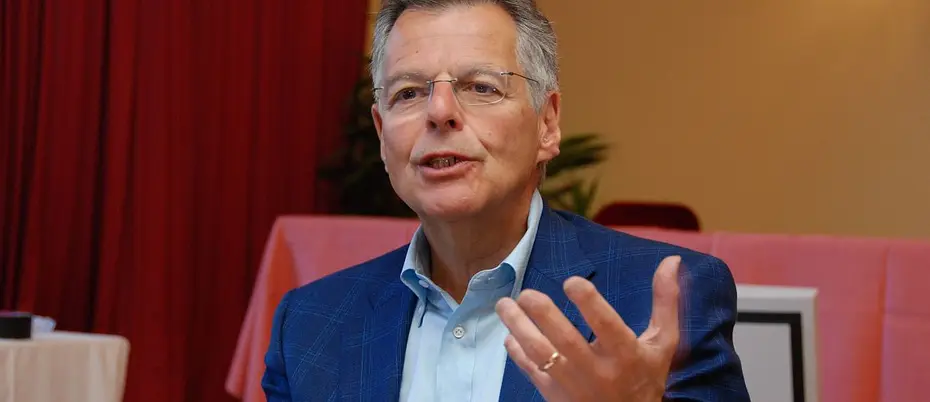

The Nobel laureate’s research has focused on understanding the effect of uncertainty on asset prices and he developed a pioneering formula for the valuation of stock options

CAMBRIDGE, Mass., January 12, 2023 – The MIT Sloan School of Management recently announced that Myron Scholes, Frank E. Buck Professor of Finance, Emeritus, at the Stanford Graduate School of Business, Nobel Laureate in Economic Sciences, and co-originator of the Black-Scholes/Merton option pricing model, was named the recipient of the S. Donald Sussman Award for the 2023–2024 academic year.

The honor is awarded to individuals or groups who best exemplify S. Donald Sussman’s career as a successful investor in quantitative investment strategies and models. Scholes was selected for his path breaking contributions to this field, as well as his research focused on understanding uncertainty and its effect on asset prices and the value of options.

“We are pleased to honor Dr. Scholes with this award in recognition of his pioneering contributions in the study and application of the science of finance,” said MIT Sloan Dean “The groundbreaking work he did as a professor here at MIT Sloan paved the way for new financial tools and better risk management in the field of investing—a legacy of innovation that continues at the school today.”

“Myron Scholes captures the essence of the Sussman Award as a finance scholar of the highest caliber who has also taken theory into investment practice successfully on multiple occasions," said MIT Sloan professor, director of MIT Sloan’s Laboratory for Financial Engineering, and a member of the award committee. "It's also a happy bit of serendipity that Myron's selection this academic year coincides with the 50th anniversary of the publication of the Black-Scholes/Merton option pricing papers, so we're looking forward to celebrating both events at MIT Sloan.”

Scholes holds a B.A. in economics from McMaster University and received both an MBA and Ph.D. from the University of Chicago. After finishing his dissertation, Scholes took an academic position at the MIT Sloan School of Management, where his asset pricing research alongside Fischer Black and Robert C. Merton resulted in the famous Black-Scholes/Merton option pricing model. Scholes was awarded the Nobel Prize in 1997 for his new method of determining the value of derivatives.

“I am excited to return to MIT Sloan to receive the Sussman Award. MIT was instrumental in launching my academic career,” said Scholes. “On the several occasions that I met Mr. Sussman, I learned from our conversations. We both respected the contributions of theory, empirical research, and their applications to the investment process. It was fifty-two years ago, when I was a young professor at MIT, that Fischer Black and I collaborated on the development of the option-pricing technology.”

Scholes continued his academic career with faculty positions at the University of Chicago Booth School of Business and Stanford University. He retired from teaching in 1996 from Stanford where he still holds the position of Frank E. Buck Professor of Finance Emeritus. Scholes has studied the effects of tax policy on asset prices and incentives and developed a new theory of tax planning under uncertainty and information asymmetry which led to a book with Mark A. Wolfson called Taxes and Business Strategies: A Planning Approach (Prentice Hall, 1991). He wrote papers on testing the efficiency of option-market prices, the tradeoffs in returns to risk in asset pricing whether total or systematic risk, the effects of dividend policy on asset prices and estimation techniques with non-synchronous trading. Among other papers, he wrote several articles on investment banking and incentives. His most recent paper is on carbon emissions and portfolio management.

Scholes is currently the Chief Strategic Investment Strategist at Janus Henderson Investors and a board member of Andersen Consulting. Previously he served as the Chairman of Stamos Capital, and Platinum Grove Asset Management and on the Dimensional Fund Advisors Board of Directors, American Century Mutual Fund Board of Directors and the Cutwater Advisory Board. He was a principal and Limited Partner at Long-Term Capital Management, L.P. and a Managing Director at Salomon Brothers.

The annual Sussman Award lecture will be held in early September 2023.

About the S. Donald Sussman Award

The award is named in honor of S. Donald Sussman, the Founder and Chairman of Paloma Partners. Since founding Paloma more than 40 years ago, Sussman has worked in many areas of investments but he is best known for his pioneering role in the backing and development of quantitative strategies and managers. He was named to the Institutional Investor-Alpha Hedge Fund Hall of Fame in 2013. He has been an active philanthropist focusing on education, the arts, and the environment.

The Sussman Award is overseen by the MIT Sloan Finance Group. Sussman lecturers receive a $100,000 cash prize and share their insights on quantitative finance and the financial industry through public lectures to be delivered at MIT Sloan during the year of the award.

About the MIT Sloan School of Management

The MIT Sloan School of Management is where smart, independent leaders come together to solve problems, create new organizations, and improve the world. Learn more at mitsloan.mit.edu.